CryptoaltcoinsTokenomics and Launches

More than half of all crypto tokens have failed — and most died in 2025

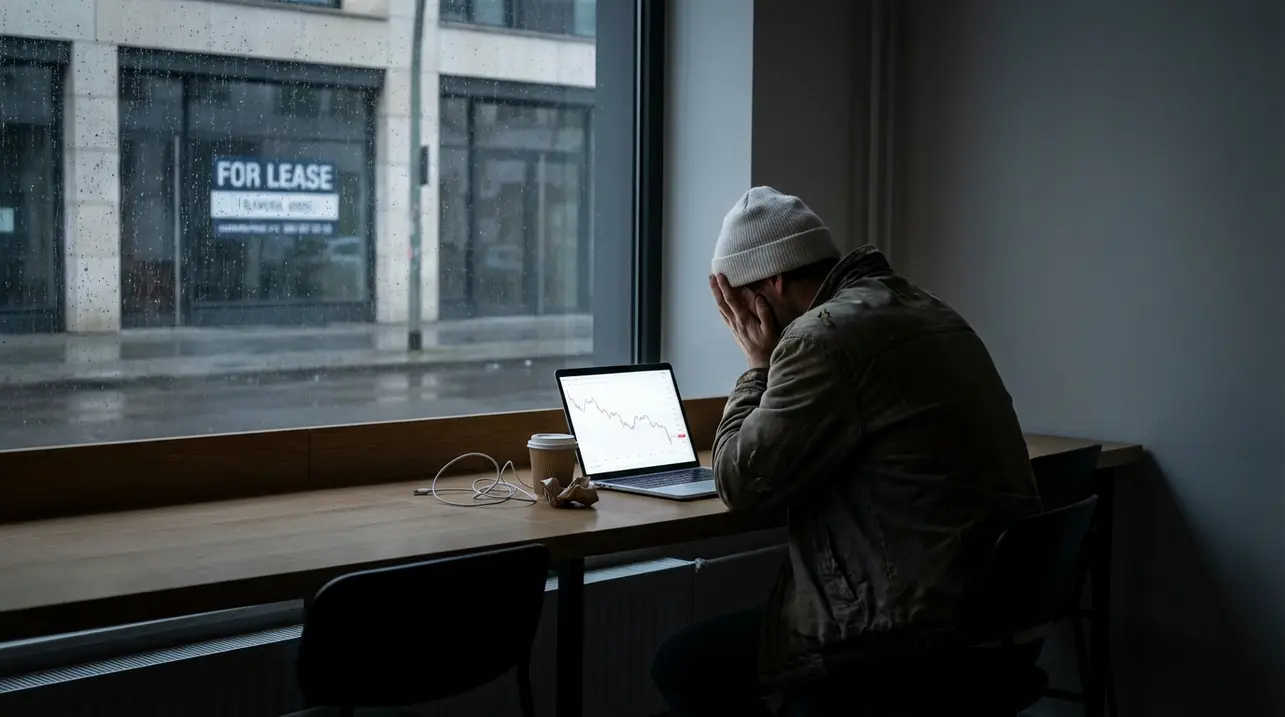

The crypto graveyard just got a whole lot more crowded. Fresh data confirms what many of us in the trenches have felt in our bones for years: over half of all crypto tokens ever launched are now dead, worthless, and abandoned.But here’s the real gut punch—the majority of these digital corpses were created in 2025. Let that sink in.In a single year, the industry managed to outpace the cumulative failure rate of its entire preceding history. This isn't just a market correction; it's a full-blown purge, a spectacular and necessary cleansing of the altcoin noise that has been drowning out the only signal that matters: Bitcoin.The pattern is brutally clear. The 2025 cohort was a perfect storm of greed, naivety, and regulatory ambiguity.Venture capital, still drunk on the fumes of the last bull run, poured billions into projects with whitepapers longer on buzzwords than on utility. We saw an explosion of 'AI-driven' tokens, 'meme-coin 3.0' ecosystems, and layer-2 solutions for problems that didn't exist, all promising to be the next Ethereum killer. Most were built on pure speculation, with teams more focused on marketing their token launch on social media than on writing a single line of functional code.The infrastructure simply couldn't support the deluge. Ethereum's gas fees remained a barrier, while newer chains like Solana and Avalanche became playgrounds for pump-and-dump schemes disguised as legitimate DeFi protocols.When the macro winds shifted and liquidity tightened, these projects—which had never achieved any meaningful adoption or built a real treasury—were the first to crumble. Their developers, often anonymous, simply pulled the liquidity, deleted their Twitter accounts, and vanished into the ether, leaving retail bag-holders with nothing but a worthless line in their MetaMask wallet.This mass extinction event is the direct consequence of a market that forgot its first principles. Bitcoin was created as a peer-to-peer electronic cash system, a sovereign, censorship-resistant asset with a provably scarce supply.The altcoin mania of 2025 was its antithesis: centralized premines, inflationary tokenomics, and founders with god-mode admin keys. The failure rate is a damning indictment of that model.Look at the survivors. They are almost exclusively projects with established networks, genuine developer communities, and clear, long-term roadmaps.Bitcoin, of course, stands apart, its hashrate and holder base only growing stronger as the altcoin casino burns down around it. Ethereum, for all its flaws, has a sprawling ecosystem of real applications, though even it is not immune to the dApp graveyard within its own network.

#featured

#crypto token failure rate

#altcoin mortality

#token launches

#market analysis

#2025 trends

#blockchain projects

#investment risk

Related News

Comments

It's quiet here...Start the conversation by leaving the first comment.

© 2026 Outpoll Service LTD. All rights reserved.