CryptoregulationCrypto Taxation

How to Report Cryptocurrency on Your Taxes

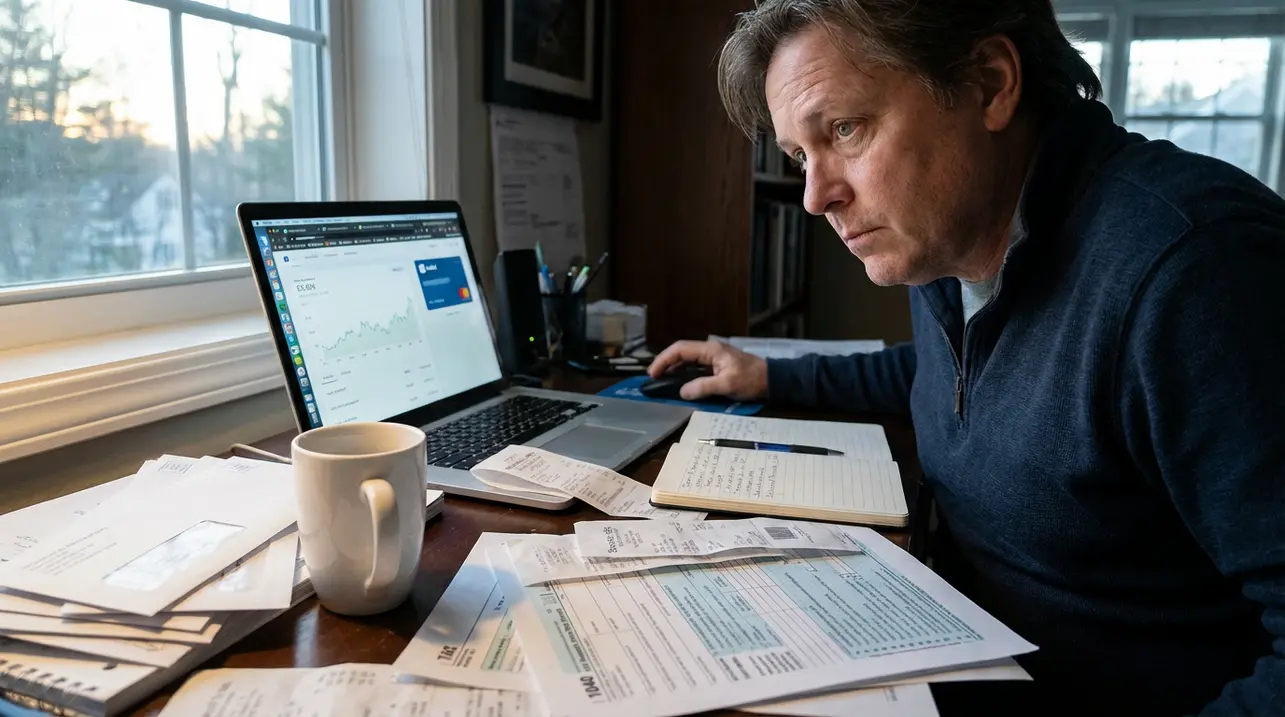

When Bitcoin first emerged over fifteen years ago, it was pitched as a radical alternative to government-controlled money—a digital asset free from politics and, most appealingly, taxes. That idealistic vision has run headlong into reality.In America, the IRS now treats cryptocurrency like any other asset, and navigating the tax rules can feel as complex as the blockchain itself. The core principle is straightforward: how you acquire your crypto dictates how it's taxed.If you receive it as payment for services or through mining, it's treated as income. You must report the fair market value in U.S. dollars at the moment you receive it, a figure you'll need to record meticulously.If you buy it as an investment, the familiar rules of capital gains apply. Selling your crypto for a profit, or even using it to buy a laptop, triggers a taxable event based on the difference between your purchase price and its value at the time of the transaction.Short-term gains (for assets held under a year) are taxed at your ordinary income rate, while long-term gains benefit from lower rates. The landscape is shifting rapidly, too.Starting with the 2025 tax year, centralized exchanges are required to file Form 1099-DA, giving the IRS a direct window into your transactions. This makes accurate record-keeping non-negotiable; a simple transfer between wallets must be categorized correctly to avoid being mistakenly reported as a sale.While the process demands diligence, the underlying message from finance experts is clear: this is no longer the Wild West. Keeping detailed logs of every transaction—the date, value, and purpose—is your first line of defense. And if the nuances of cost basis and capital gains make your head spin, consulting a tax professional familiar with digital assets isn't just advice; it's a smart investment in peace of mind.

#crypto taxes

#IRS

#capital gains

#Form 1099-DA

#tax reporting

#Bitcoin

#featured

Related News

Comments

It's quiet here...Start the conversation by leaving the first comment.

© 2026 Outpoll Service LTD. All rights reserved.