Posts from @Outpoll

The US trade deficit increased to $70.3 billion, bringing the annual deficit to $901B.

This is one of the largest annual trade deficits in the past 65 years. The increase was driven by a 3.6% rise in imports and a 1.7% decline in exports.

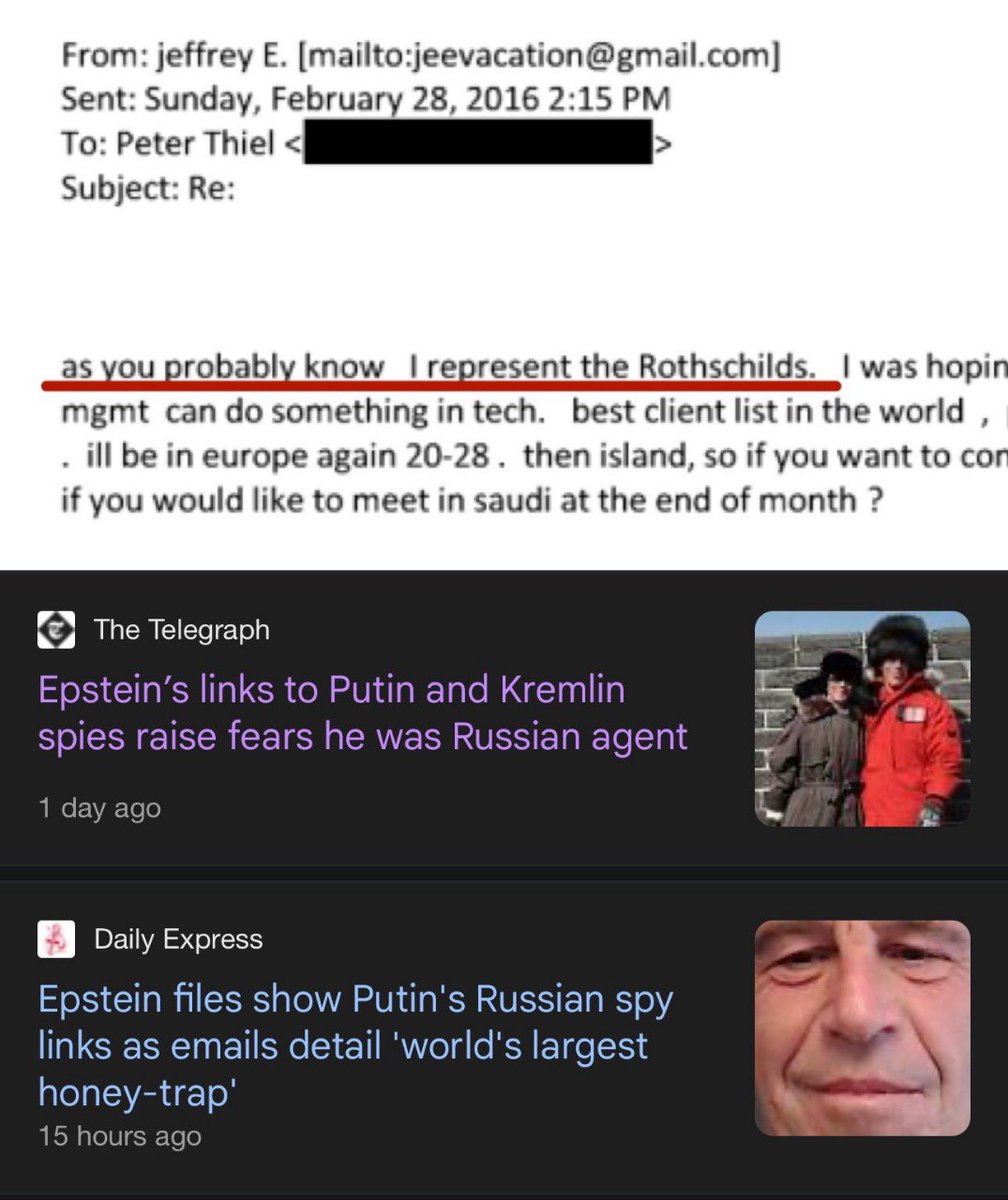

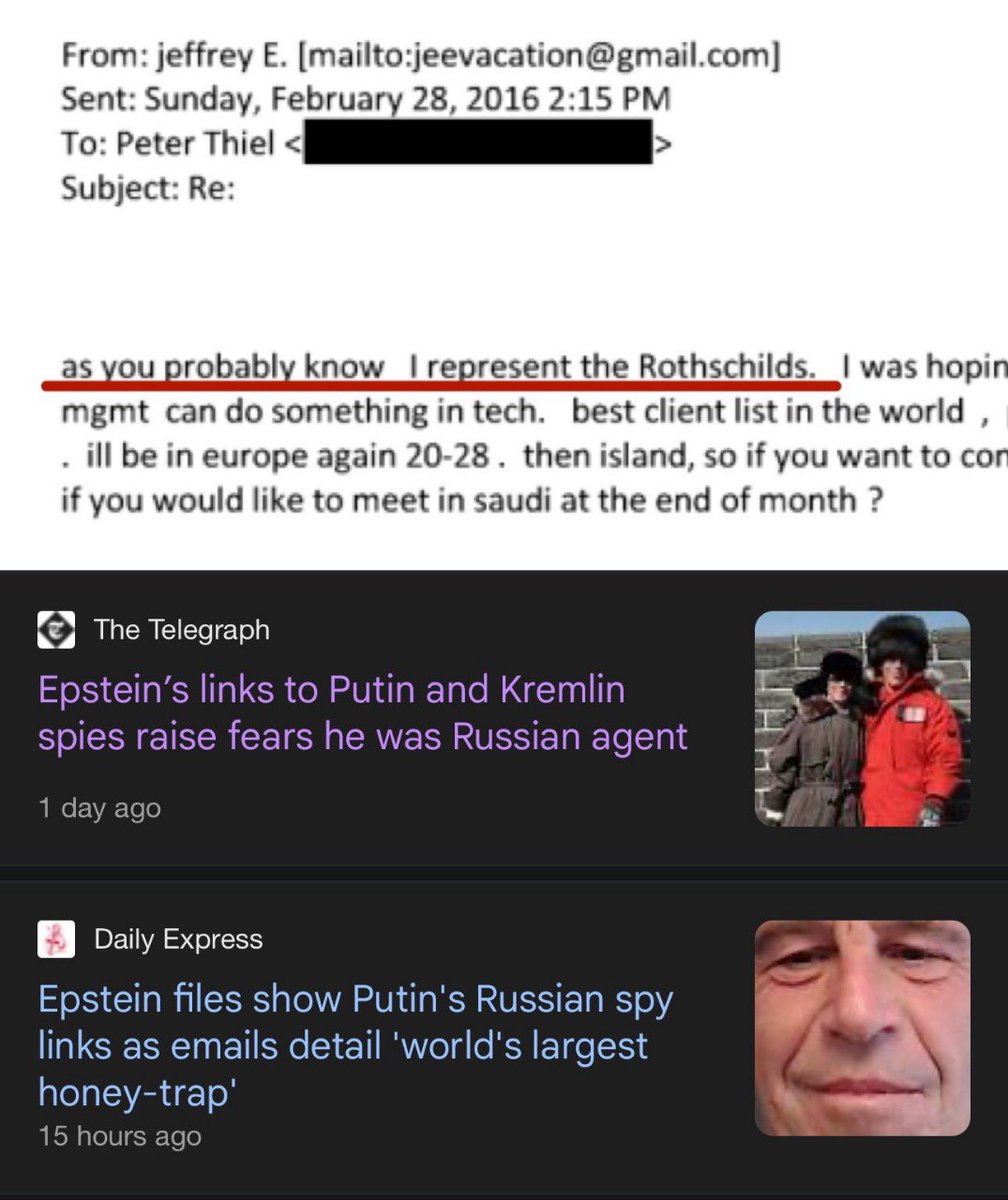

That's all you need to know about liberal media: whenever you see something happening in the world, always find a way to bring Russia into it 😂

🇺🇸😎⚡️This year, the first bank in the US went bankrupt: Metropolitan Capital Bank & Trust was shut down and placed under the external management of the Federal Deposit Insurance Corporation (FDIC). Are new bank failures expected in 2026? 🤔

The first one is down ☕️🔥

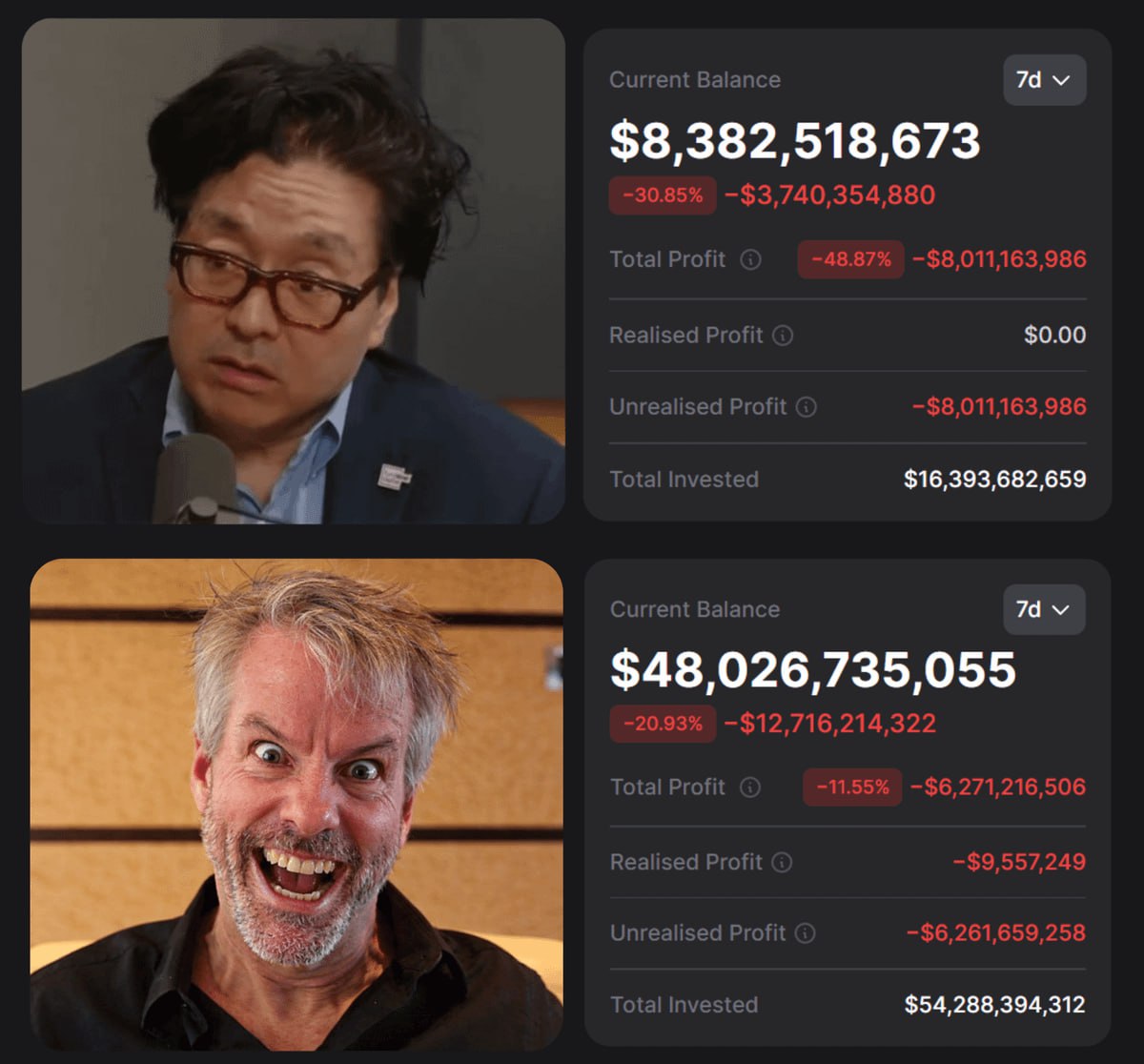

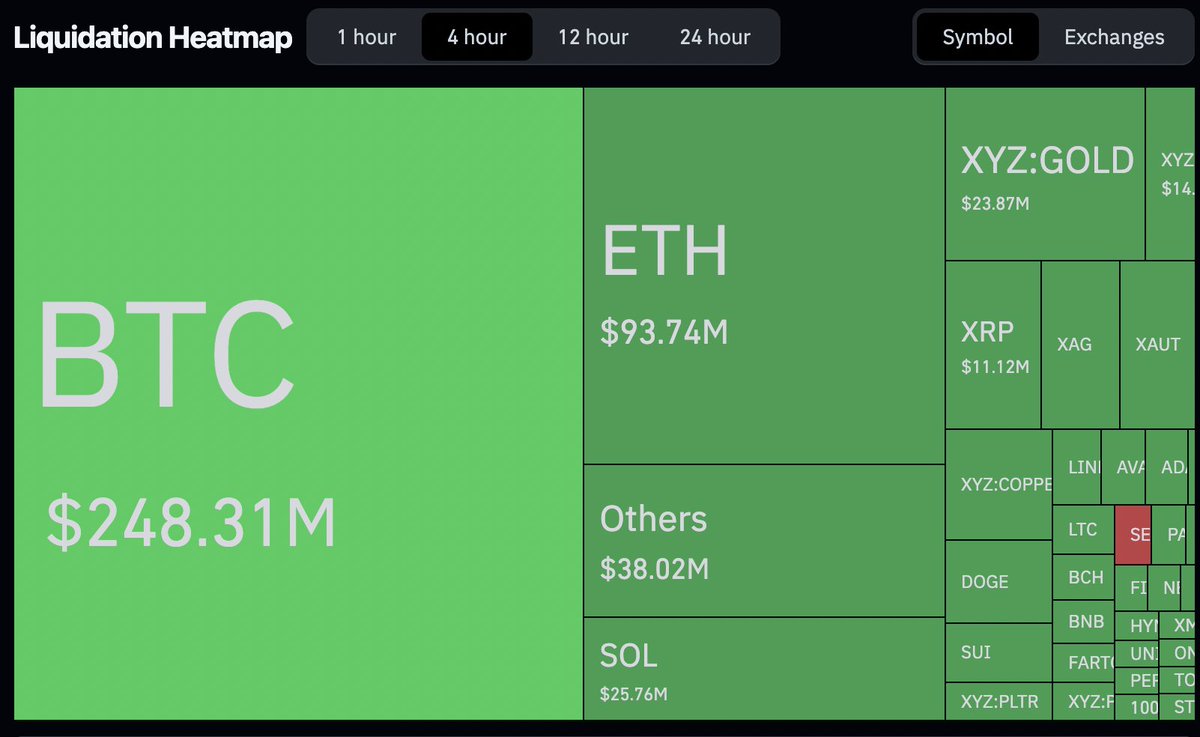

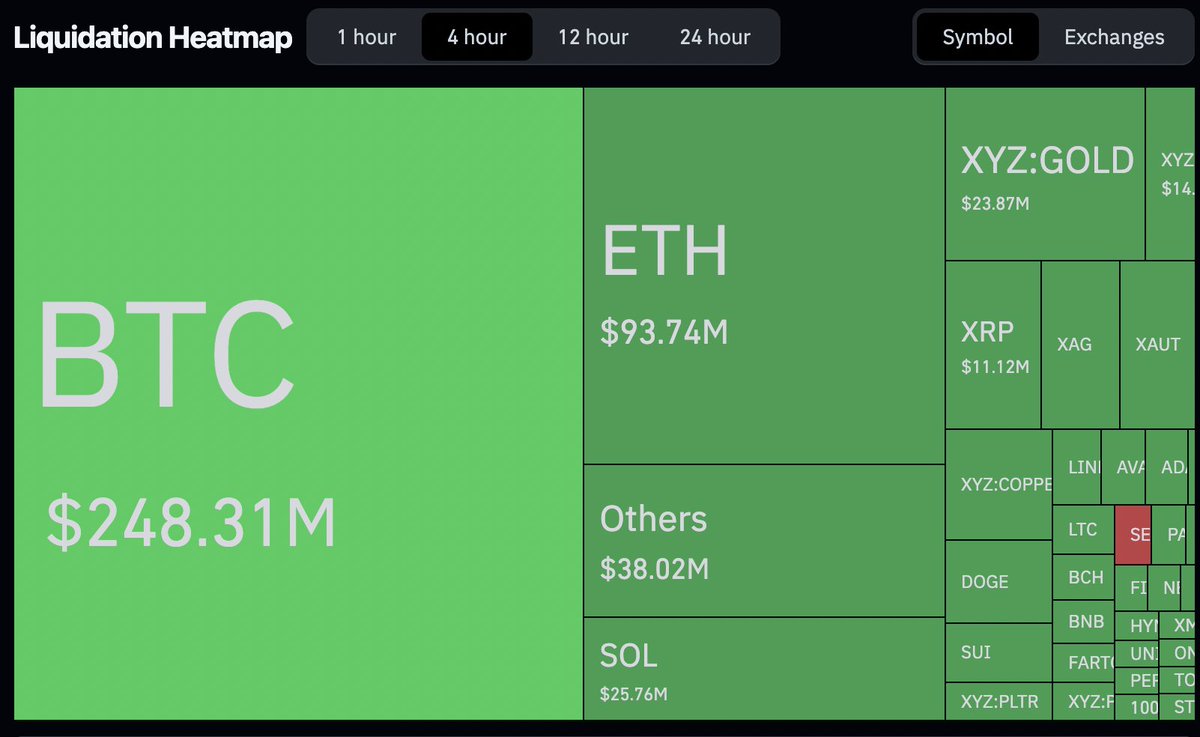

JUST IN: $500M+ of long positions wiped out in the crypto market over the past 4 hours

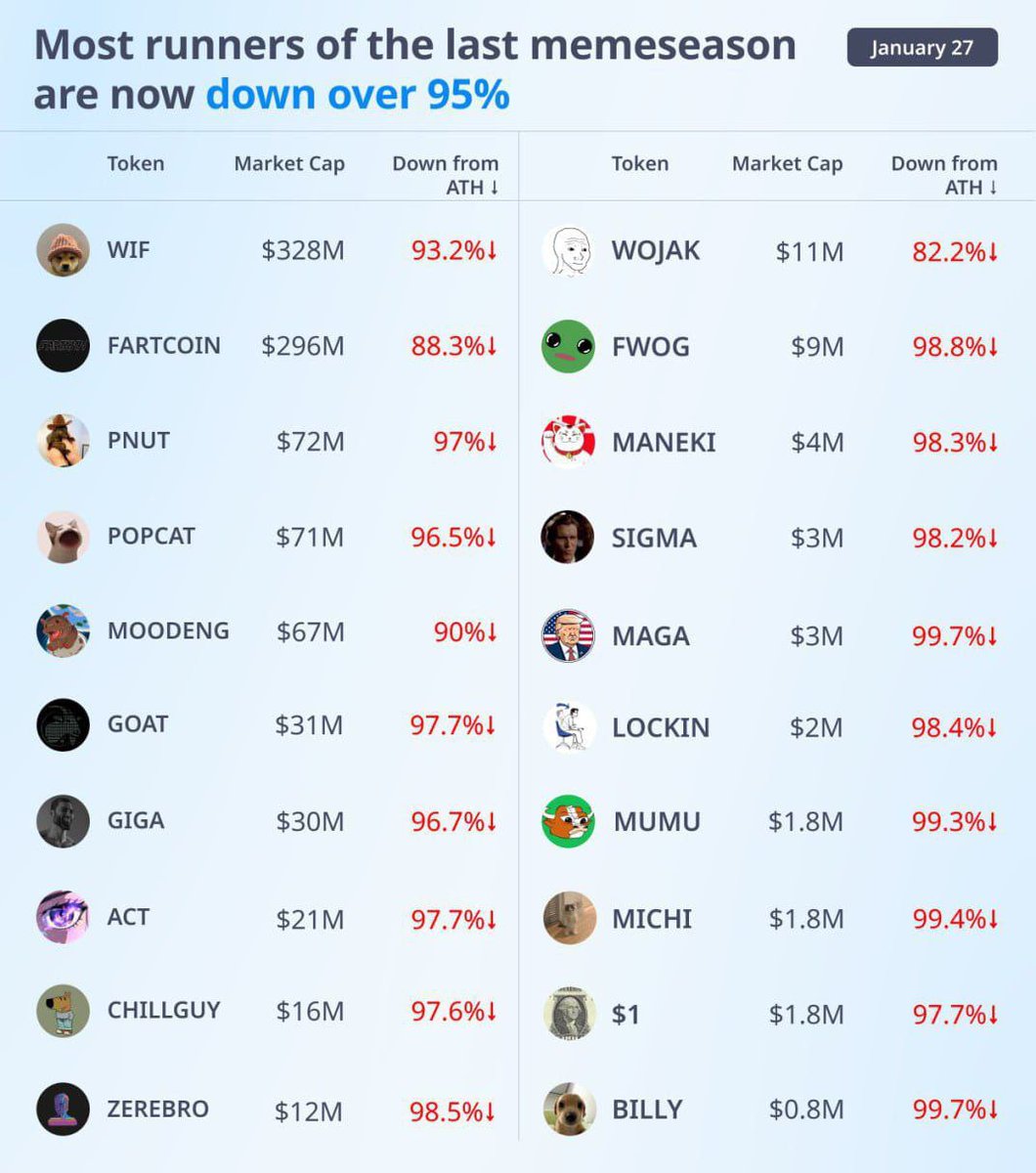

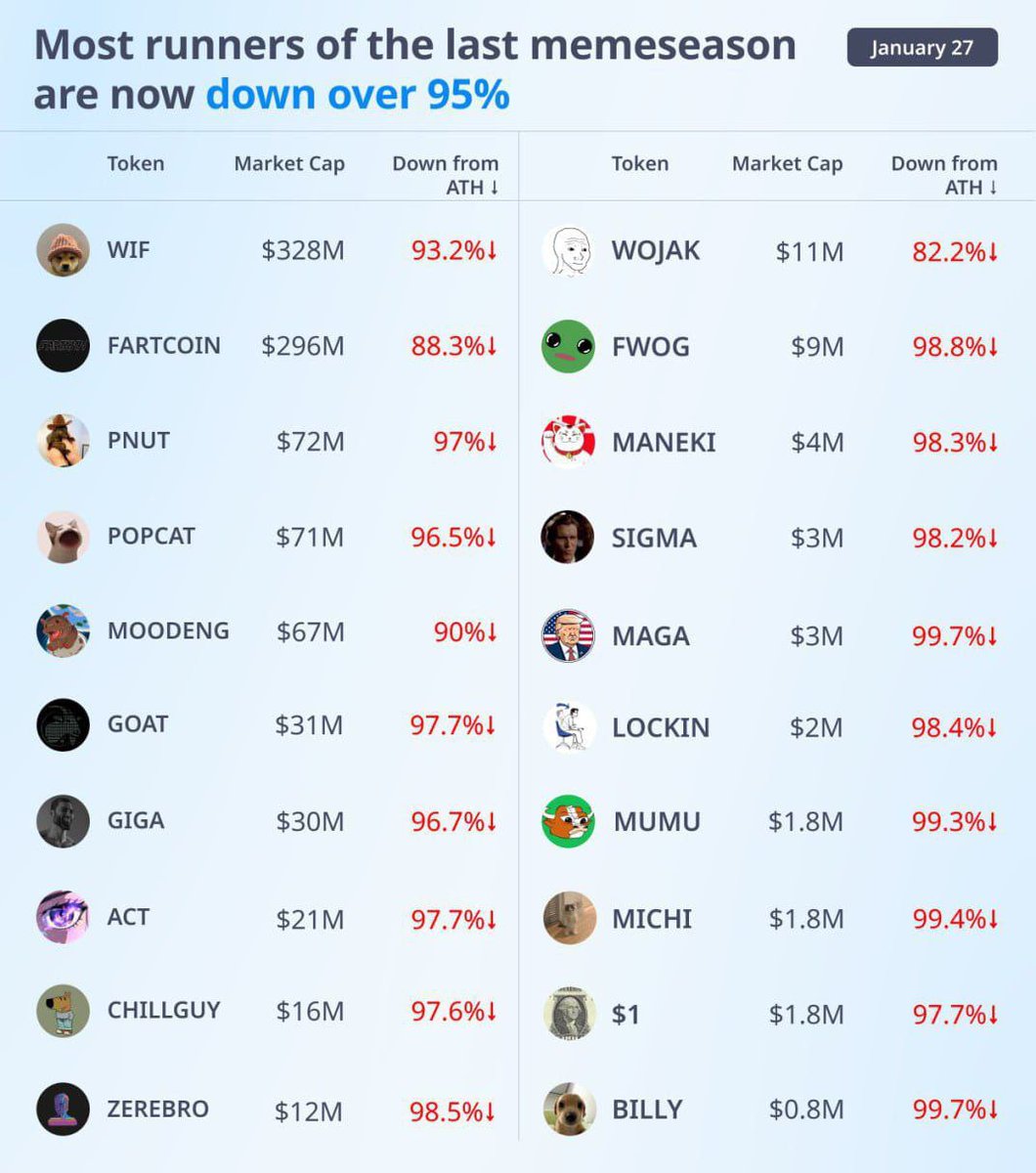

The most well-known meme coins have fallen by 88% or more from their peak

The US trade deficit increased to $70.3 billion, bringing the annual deficit to $901B.

This is one of the largest annual trade deficits in the past 65 years. The increase was driven by a 3.6% rise in imports and a 1.7% decline in exports.

That's all you need to know about liberal media: whenever you see something happening in the world, always find a way to bring Russia into it 😂

🇺🇸😎⚡️This year, the first bank in the US went bankrupt: Metropolitan Capital Bank & Trust was shut down and placed under the external management of the Federal Deposit Insurance Corporation (FDIC). Are new bank failures expected in 2026? 🤔

The first one is down ☕️🔥

JUST IN: $500M+ of long positions wiped out in the crypto market over the past 4 hours

The most well-known meme coins have fallen by 88% or more from their peak

Other News

© 2026 Outpoll Service LTD. All rights reserved.