CryptostablecoinsRegulation and Audits

The Threat of Stablecoins to Government Monetary Control

DA

David Collins

3 hours ago7 min read2 comments

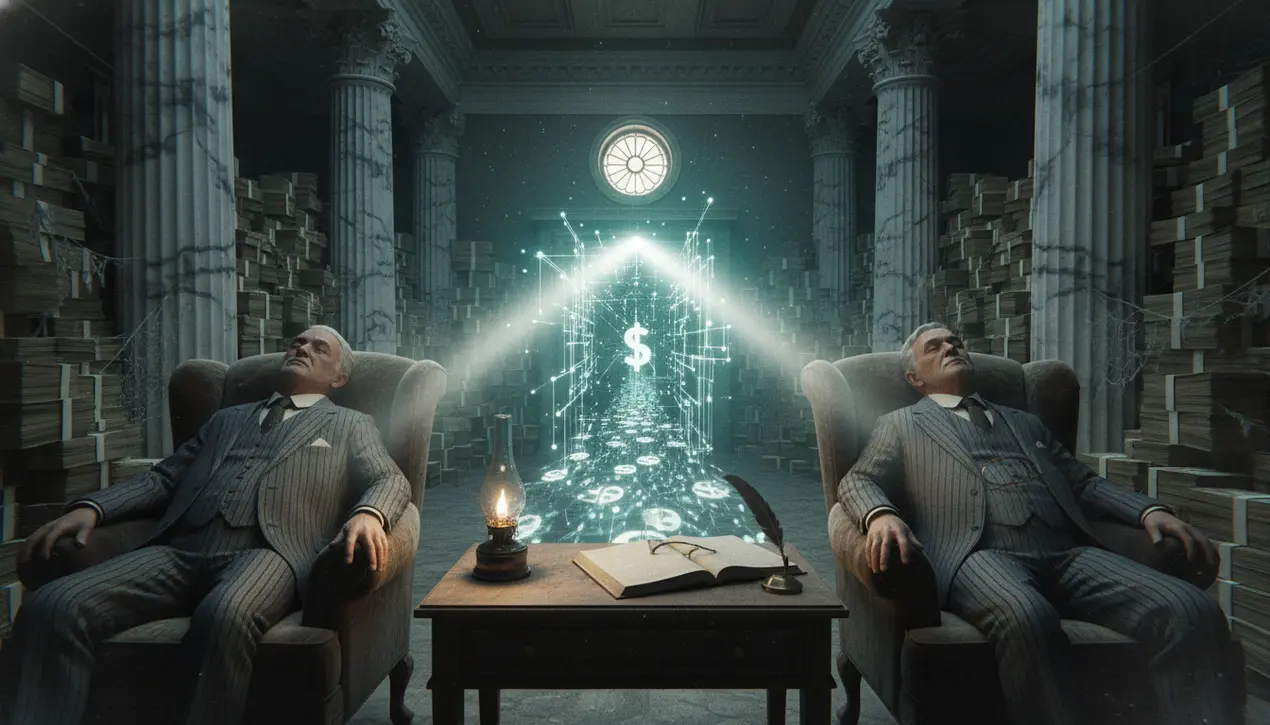

The establishment is sleeping at the wheel while a financial revolution gathers force right under their noses. Stablecoins aren't just another crypto fad; they are a direct, existential threat to the very foundation of government monetary control, a silent run on the state's ability to manage inflation, stabilize markets, and, most critically, finance its endless appetite for public spending through debt.For decades, the global financial system has operated on a simple, brutal truth: the state holds the monopoly on money. Through central banks like the Federal Reserve, governments can print currency at will, setting interest rates and controlling the money supply to steer the economic ship—however clumsily.This power is the engine of modern fiscal policy, allowing for everything from quantitative easing to stimulus packages. But stablecoins—digital assets pegged to stable reserves like the US dollar—are fundamentally dismantling this monopoly.They create a parallel, borderless financial system where dollars exist outside the control of the Federal Reserve's balance sheet. Imagine a world where citizens and corporations increasingly transact in USDC or USDT instead of bank-deposited dollars.The Fed's primary tools, like adjusting the federal funds rate, become blunted. Their ability to cool an overheating economy by making borrowing more expensive weakens when a significant portion of economic activity occurs in a system they cannot directly influence.This isn't theoretical. We've seen glimpses of this power shift in countries with hyperinflation, where citizens flock to cryptocurrencies, including stablecoins, to preserve their wealth from irresponsible governments.The United States, however, is playing a uniquely dangerous game. By cautiously entertaining regulation that caters to a politically connected crypto industry, Washington is effectively legitimizing the very instrument that could unravel its authority.The recent dance around the Clarity for Payment Stablecoins Act is a perfect example of this myopia—a debate focused on consumer protection and market structure while ignoring the colossal, systemic risk. The core of the threat lies in the management of government debt.US Treasury bonds are the bedrock of global finance and the primary tool for funding government deficits. The demand for these bonds is, in part, artificially sustained by regulations that require banks and institutions to hold them.A large-scale migration into stablecoins could disrupt this delicate ecosystem. If corporations park their cash in stablecoins rather than Treasury bills, demand for government debt could fall, forcing higher interest rates and making public spending prohibitively expensive.This is the 'playing with fire' scenario. It’s not about replacing the dollar tomorrow; it’s about a gradual, insidious erosion of monetary sovereignty.The Bank for International Settlements, the so-called central bank for central banks, has repeatedly warned about this, noting that stablecoins could fragment the monetary system and challenge the unit of account function of sovereign currency. Of course, the crypto-skeptics will scoff, pointing to the volatility and failures in the space like Terra/Luna.But these failures are growing pains, not fatal flaws. Each collapse leads to more robust, transparent, and resilient systems.The trajectory is clear. The genie is out of the bottle, and no amount of regulatory hand-wringing or half-hearted legislation will put it back.The coming conflict won't be between Bitcoin and gold; it will be between decentralized, apolitical money protocols and the century-old doctrine of state-controlled finance. The US government, in its hubris, believes it can tame this beast and co-opt it.They are wrong. They are negotiating the terms of their own irrelevance.

#stablecoins

#government control

#monetary policy

#public debt

#regulation

#featured

Stay Informed. Act Smarter.

Get weekly highlights, major headlines, and expert insights — then put your knowledge to work in our live prediction markets.

Related News

Comments

Loading comments...

© 2025 Outpoll Service LTD. All rights reserved.