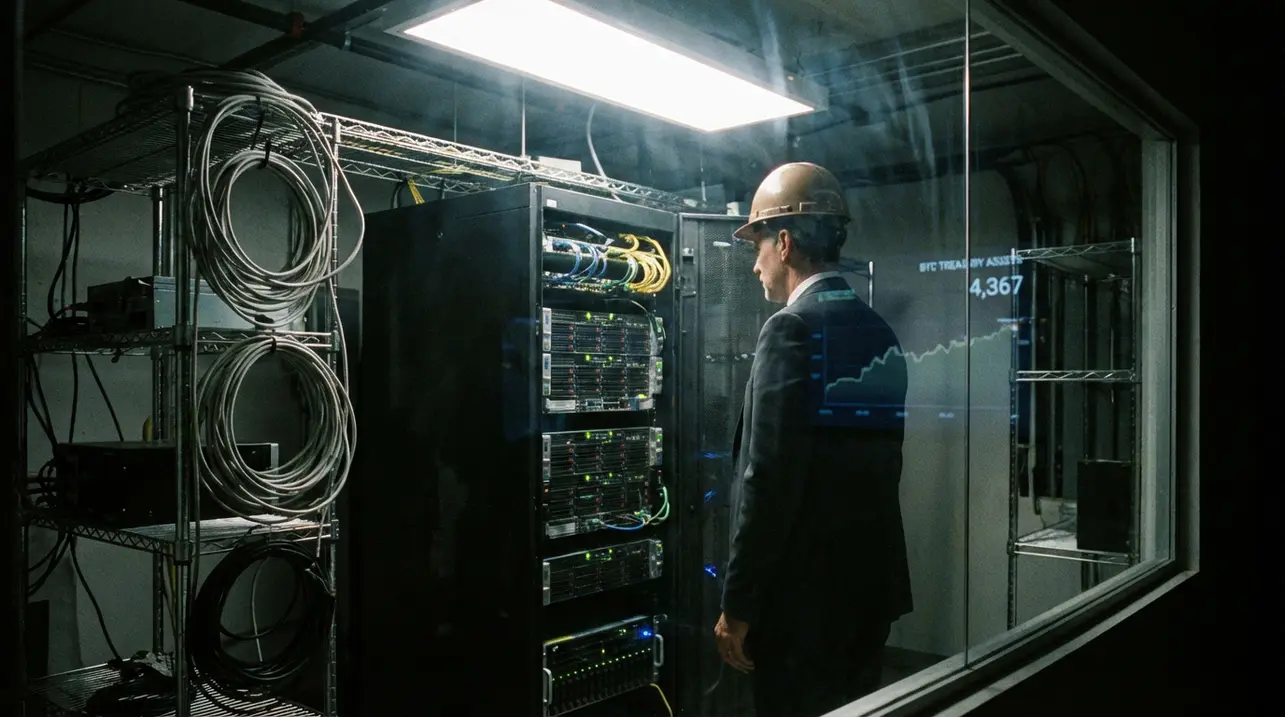

CryptominingBitcoin Mining

Eric Trump’s American Bitcoin bought $34 million in BTC during November slump

DA

4 days ago7 min read

In a move that should surprise absolutely no one paying attention, the Trump-affiliated bitcoin mining and treasury firm, American Bitcoin, has just disclosed a staggering position of 4,367 BTC as of this Tuesday. Let’s cut through the noise: this isn’t just another corporate treasury allocation.This is a $34 million bet, placed squarely during November’s gut-wrenching market slump, and it screams a defiant, maximalist creed directly into the face of a skittish financial establishment. While the crypto-twitterati were wringing their hands over FTX contagion and regulatory saber-rattling, Eric Trump’s operation was doing what true believers do—stacking sats when fear is at its peak.This isn’t diversification; it’s a declaration. It’s the financial equivalent of planting a flag on the moon, a bold assertion that Bitcoin, and only Bitcoin, represents the ultimate hedge against a system built on fiat debasement and political caprice.The timing is impeccable, classic contrarian investing 101, but executed with the theatrical flair we’ve come to expect from anything bearing the Trump name. Think about the context.November saw Bitcoin battered, stumbling below key psychological levels as the post-ETF approval euphoria evaporated and macro fears resurfaced. The weak hands were fleeing, the media narrative turned sour, and the usual suspects began their chorus of ‘I told you so.’ Into that void of uncertainty, American Bitcoin deployed capital with cold, calculated precision. They weren’t buying a narrative about Web3 or the future of decentralized finance; they were buying the bedrock asset itself, the digital gold that stands apart from the altcoin carnival and the vaporware promises that saturate this space.This purchase is a masterclass in signal versus noise. While the broader ‘crypto’ sector drowns in its own complexity—endless debates about tokenomics, validator rewards, and layer-2 scaling solutions—the Trump-linked firm’s strategy is brutally simple: acquire the hardest, most scarce money ever created.It echoes the philosophy of early adopters like Michael Saylor and MicroStrategy, but injects it with a potent dose of political symbolism. This isn’t just a tech bet; it’s a geopolitical one.It aligns the Trump brand, synonymous with economic nationalism and distrust of federal overreach, with the most potent anti-establishment financial instrument of the 21st century. The implications are profound.First, it legitimizes Bitcoin’s store-of-value thesis at an institutional level, but from a uniquely American, politically-charged angle. It’s not a sterile hedge fund play; it’s a strategic asset for a parallel financial system.

#featured

#Eric Trump

#American Bitcoin

#bitcoin mining

#BTC holdings

#institutional adoption

#treasury firm

#November slump

Stay Informed. Act Smarter.

Get weekly highlights, major headlines, and expert insights — then put your knowledge to work in our live prediction markets.

Related News

Comments

Loading comments...

© 2025 Outpoll Service LTD. All rights reserved.