Financestocks

Tesla aims to de-risk supply chain from Chinese components.

TH

Thomas Green

2 days ago7 min read3 comments

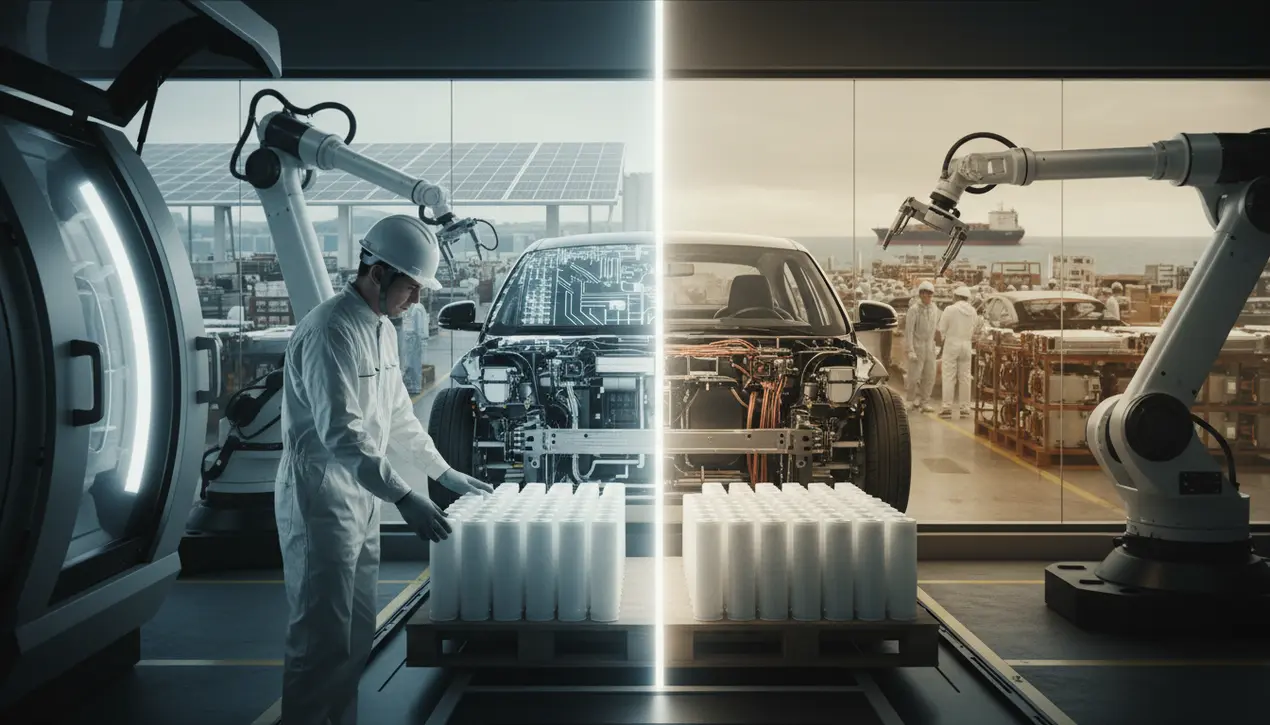

Tesla’s ambitious gambit to systematically extract Chinese-made components from its US-built vehicles represents more than a mere supply chain adjustment; it's a fundamental realignment echoing the grand strategic pivots of the space race, a move that CEO Elon Musk, a visionary I’ve long followed for his Mars colonization ethos, would appreciate as a necessary maneuver in the high-stakes theater of global economics and geopolitics. According to Curt Hopkins, CEO of MCQ Markets in Miami, Tesla is effectively architecting a 'completely dual strategy,' a corporate schism where its American operations aggressively 'de-China' and diversify, while its formidable Shanghai Gigafactory continues to leverage the dense, cost-effective manufacturing ecosystem of China for regional and other international markets.This bifurcation isn't occurring in a vacuum. It aligns with a 'significant strategy' embedded within America's national industrial policy, a response to years of pandemic-induced disruptions, escalating trade tariffs, and an increasingly tense geopolitical climate that has seen Washington and Beijing engage in a technological cold war, with semiconductors and electric vehicle batteries as the new battleground.Giants from Apple to General Motors are similarly seeking to 'completely de-risk' their supply chains, a term that belies the monumental complexity of untangling decades of deeply integrated global manufacturing, particularly for the intricate web of rare earth minerals, lithium-ion cells, and advanced electronics that power modern EVs. The historical precedent here is profound; it recalls the strategic autarky pursued by nations during periods of conflict or intense rivalry, where self-sufficiency becomes a paramount security objective.For Tesla, a company that has thrived on vertical integration, this push presents both a colossal challenge and a potential competitive moat. On one hand, sourcing batteries, magnets, and chips outside of China, likely from developing partnerships in countries like Canada for nickel, Australia for lithium, and perhaps India for certain components, will inevitably increase short-term costs and logistical headaches.On the other, it insulates the company from the catastrophic disruption of a potential Taiwan contingency or further US-China decoupling, future-proofing its most profitable market. Expert commentary from analysts at firms like BloombergNEF suggests this transition will take years, not months, to implement without crippling production lines.The consequences ripple outward: a boon for manufacturing hubs in Mexico and Southeast Asia as Tesla and its suppliers seek alternative clusters, a potential slowdown in the global adoption rate of EVs as prices recalibrate, and a fascinating test case for whether a multinational corporation can successfully operate two parallel, geographically distinct supply chains for the same product. This is not just business; it's a high-orbit strategic play, a calculated bet on the shape of the next decade's world order, with Tesla positioning its US operations as a fortress against geopolitical storms while its Eastern arm continues to conquer growth markets, a dual trajectory as complex and daring as launching a rocket towards the red planet.

#Tesla

#electric vehicles

#supply chain

#de-risking

#US-China trade

#auto industry

#featured

Stay Informed. Act Smarter.

Get weekly highlights, major headlines, and expert insights — then put your knowledge to work in our live prediction markets.

Related News

Comments

Loading comments...

© 2025 Outpoll Service LTD. All rights reserved.