CryptostablecoinsUSDT and Tether

Tether may lead $1.2 billion round in German Robotics startup: FT

CH

Chloe Evans

2 hours ago7 min read

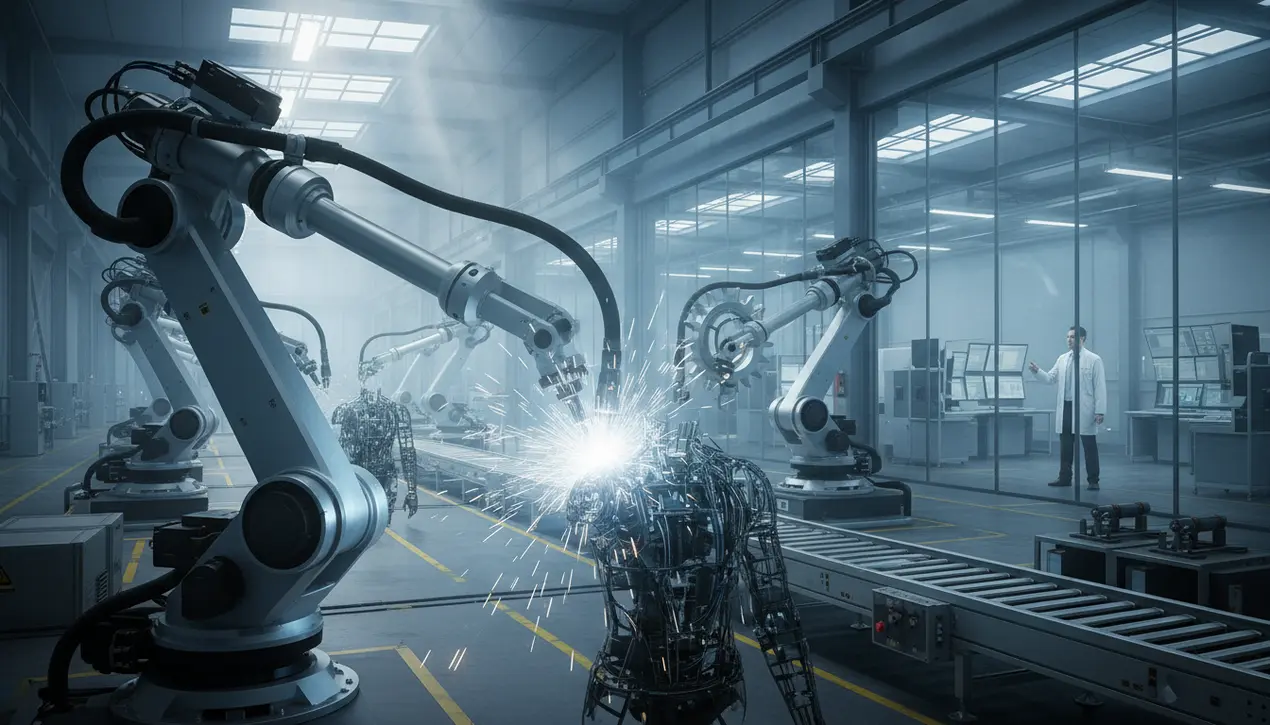

In a move that further blurs the lines between the digital and traditional financial worlds, Tether Holdings Ltd. , the behemoth behind the world’s largest stablecoin USDT, is reportedly in advanced talks to spearhead a monumental $1.2 billion funding round for a German robotics startup, according to a Financial Times scoop. This isn't just another corporate investment; it's a seismic strategic pivot.Tether, which has historically been viewed through the narrow lens of a stablecoin utility provider, has generated staggering profits exceeding $10 billion in just the first three quarters of this year, primarily from its holdings of U. S.Treasury bills. This war chest has now ignited an aggressive diversification campaign, moving far beyond the crypto-native ecosystem into the tangible, gear-grinding realm of physical technology.The German target, while unnamed, represents a deliberate foray into Industry 4. 0—the fusion of AI, IoT, and advanced robotics that is revolutionizing manufacturing and logistics.This signals a profound maturation for the company, as it seeks to anchor its immense, digitally-derived wealth in assets that produce real-world value and innovation. For market observers, this is a classic TradFi maneuver executed by a DeFi giant: deploying capital from low-risk, liquid instruments into high-growth, venture-style equity.It echoes the playbooks of sovereign wealth funds and tech conglomerates like SoftBank's Vision Fund, yet it’s being orchestrated by an entity born from blockchain. The implications are vast.For the crypto industry, it demonstrates a path to sustainable treasury management beyond mere crypto speculation, potentially setting a precedent for other cash-flush projects like Circle or even Ethereum's endowment. For the robotics sector, it signifies the arrival of a new, deep-pocketed investor class unafraid of billion-dollar bets.However, it also raises critical questions about regulatory scrutiny, as global watchdogs will undoubtedly scrutinize the flow of capital from a system they are still struggling to define into sensitive areas of strategic technology. Is this a masterstroke of portfolio hedging, or a risky overreach into an unfamiliar industrial landscape? Only time will tell, but one thing is certain: the walls between crypto and the physical economy are not just crumbling—they are being actively dismantled by a stablecoin titan with ambitions as large as its balance sheet.

#Tether

#investment

#robotics

#stablecoin

#profits

#diversification

#featured

Stay Informed. Act Smarter.

Get weekly highlights, major headlines, and expert insights — then put your knowledge to work in our live prediction markets.

Related News

Comments

Loading comments...

© 2025 Outpoll Service LTD. All rights reserved.