CryptoregulationAsia-Pacific Regulations

Japan moves to reclassify crypto and adopt major tax relief: report

CH

Chloe Evans

3 hours ago7 min read

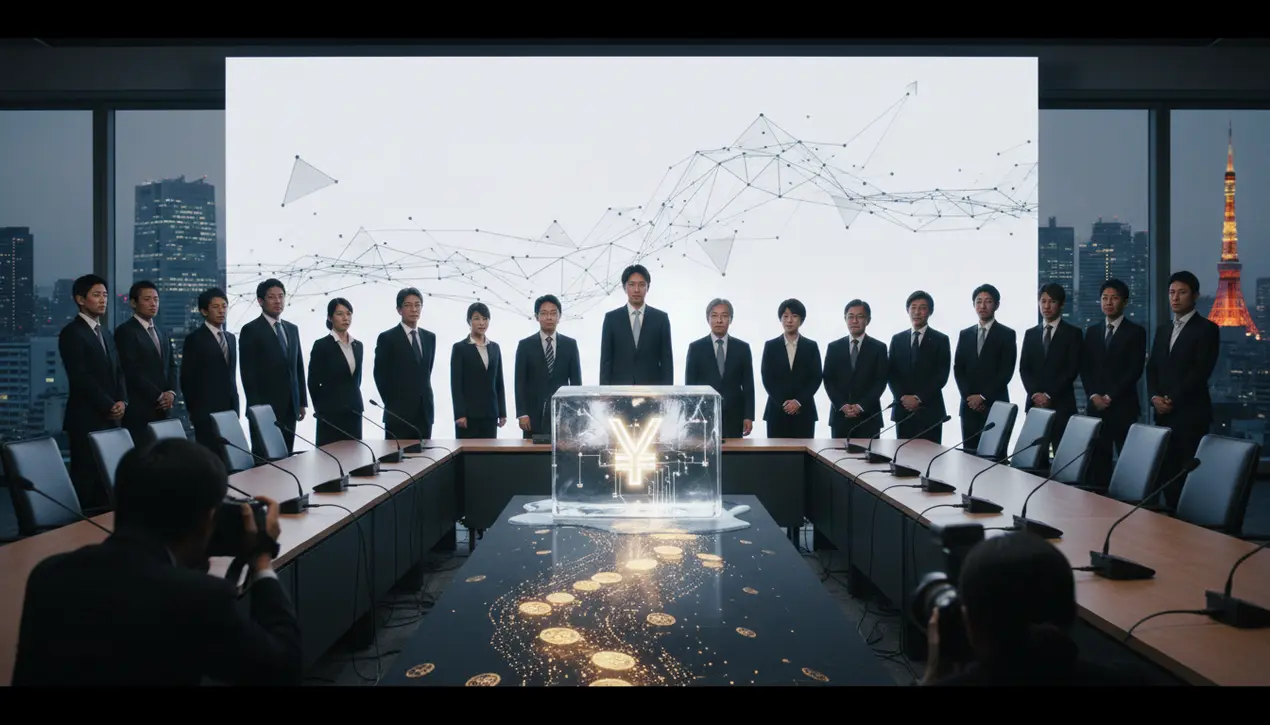

In a tectonic shift for one of Asia's most mature digital asset markets, Japan's Financial Services Agency has finalized a landmark proposal to reclassify 105 cryptocurrencies as legitimate financial products, a move first reported by Asahi that signals Tokyo's accelerating embrace of Web3 infrastructure. This regulatory recalibration, far from mere bureaucratic reshuffling, represents the culmination of a multi-year dialogue between Japan's traditionally conservative financial establishment and its burgeoning crypto sector—a sector that has weathered everything from the catastrophic Mt.Gox collapse to stringent capital requirements that once drove innovators offshore. The immediate and most tangible impact lies in the realm of taxation, where this reclassification paves the way for corporations holding these designated assets to escape the punitive 'unrealized gains' tax that has long forced them to pay levies on paper profits each fiscal year, irrespective of whether they sold any tokens.This alone could unleash a wave of institutional capital, as publicly traded companies and investment funds previously deterred by the accounting nightmare can now hold crypto on their balance sheets without facing annual tax bills that could bankrupt them during market downturns. The strategic implications are profound, positioning Japan to directly compete with financial hubs like Hong Kong and Singapore, which have aggressively courted crypto enterprises with favorable regulatory climates.The list of 105 tokens, while not yet publicly detailed, is expected to include major players like Bitcoin and Ethereum, but the true test will be its inclusivity towards newer, innovative projects in the DeFi and NFT spaces, areas where Japan has historically been cautious. This isn't happening in a vacuum; it's part of a global regulatory convergence, echoing the European Union's MiCA framework and the United States' ongoing, albeit messy, attempts to legislate digital assets.For the TradFi world, this is a clarion call; the wall between conventional finance and the crypto ecosystem is not just being scaled—it's being dismantled brick by brick, with tokenized assets and blockchain-based settlement poised to become mainstream. The FSA's move demonstrates a sophisticated understanding that you cannot foster innovation while strangling it with legacy rules, a lesson other G7 nations are still grappling with.Expect Japanese megabanks and securities firms, which have been quietly building digital asset divisions for years, to now move these initiatives from pilot to production, offering crypto custody, trading, and staking services to a retail and institutional audience that has been waiting for a trusted, regulated on-ramp. The long-term play is clear: Japan is not merely accommodating crypto; it is systematically integrating it into the very fabric of its financial system, betting that the future of finance is programmable, transparent, and built on a digital foundation.

#lead focus news

#Japan

#cryptocurrency

#regulation

#tax relief

#financial products

#crypto assets

Stay Informed. Act Smarter.

Get weekly highlights, major headlines, and expert insights — then put your knowledge to work in our live prediction markets.

Related News

Comments

Loading comments...

© 2025 Outpoll Service LTD. All rights reserved.