FinancemacroeconomyGDP Reports

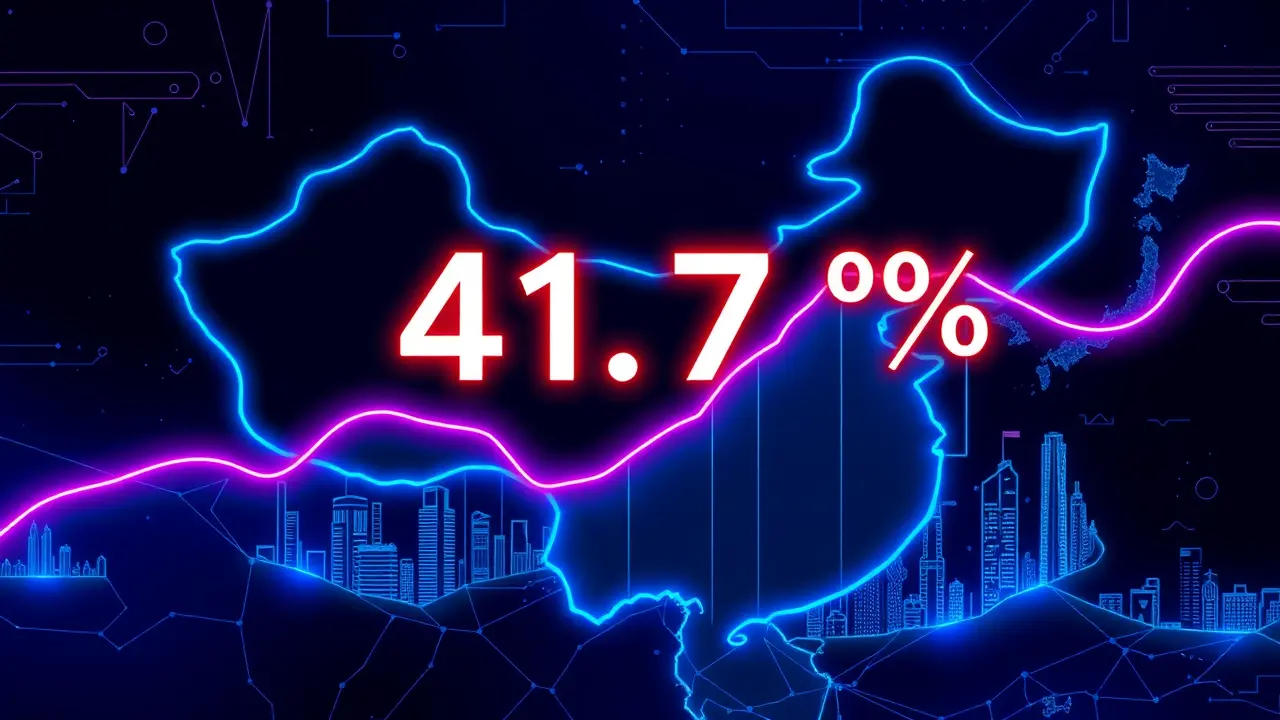

China Sets 4.17% Annual GDP Growth Target Through 2035

OL

Olivia Scott

14 hours ago7 min read3 comments

China has officially delineated a 4. 17% average annual GDP growth trajectory as the essential benchmark to fulfill its long-term development ambitions through 2035, a target that arrives amidst the formidable demographic headwind of a projected population contraction over the coming decade.This figure, emerging from the latest proposals for the country’s next five-year plan unveiled by the Communist Party’s Central Committee, provides a rare and crucial quantitative clarity into what Beijing’s economic strategists deem a successful execution of their long-range vision, effectively setting the playing field for global markets and international observers who parse every datum from the world's second-largest economy. The specificity of the 4.17% goal is particularly telling; it is not an aspirational ceiling but a calculated floor, a necessary velocity to double the size of the economy from 2020 levels by 2035, a pledge made by President Xi Jinping that now requires navigating an economic landscape radically different from the double-digit growth era. This pivot from quantity to quality of growth underscores a fundamental recalibration, where the old engines of debt-fueled infrastructure and property development are being systematically throttled back in favor of advanced manufacturing, technological self-sufficiency, and domestic consumption—a transition as precarious as it is ambitious.Analysts from Goldman Sachs to the World Bank are already modeling the implications, noting that achieving this steady mid-four percent pace will demand significant productivity gains to offset a shrinking labor force, requiring deeper structural reforms in state-owned enterprises and a more robust social safety net to unlock household spending. The shadow of Japan’s 'lost decades' looms large in these deliberations, a cautionary tale of how demographic decline can anchor an economy into prolonged stagnation if not met with aggressive innovation and policy agility.From a Wall Street perspective, this target signals a managed deceleration, a controlled burn rather than a hard landing, which could stabilize commodity markets and offer predictable, albeit slower, returns for multinational corporations deeply embedded in Chinese supply chains. However, the inherent tensions are palpable: can the state-directed financial system efficiently allocate capital to the high-tech 'little giant' firms while managing a property sector correction and local government debt exceeding $10 trillion? The People's Bank of China walks a monetary tightrope, needing to provide sufficient stimulus without re-inflating asset bubbles or triggering capital flight, a balancing act that will keep Fed watchers and ECB officials intently focused on Shanghai interbank rates.Furthermore, this growth blueprint is inextricably linked to China's geopolitical aspirations, as economic muscle funds military modernization and the Belt and Road Initiative's global influence campaigns; falling short of the 4. 17% benchmark would not merely be a domestic statistical shortfall but a direct constraint on Beijing's strategic capacity to challenge US hegemony. The coming years will thus represent the ultimate stress test for the Chinese model of state capitalism, a grand experiment watched with a mixture of apprehension and opportunity from trading floors in New York to cabinet meetings in Berlin, where the ripple effects of every tenth of a percentage point in China's GDP will recalibrate global inflation, interest rates, and the very balance of power in the 21st century.

#featured

#China

#GDP growth

#economic target

#2035

#five-year plan

#macroeconomy

Stay Informed. Act Smarter.

Get weekly highlights, major headlines, and expert insights — then put your knowledge to work in our live prediction markets.

© 2025 Outpoll Service LTD. All rights reserved.