FinancemacroeconomyDebt and Deficits

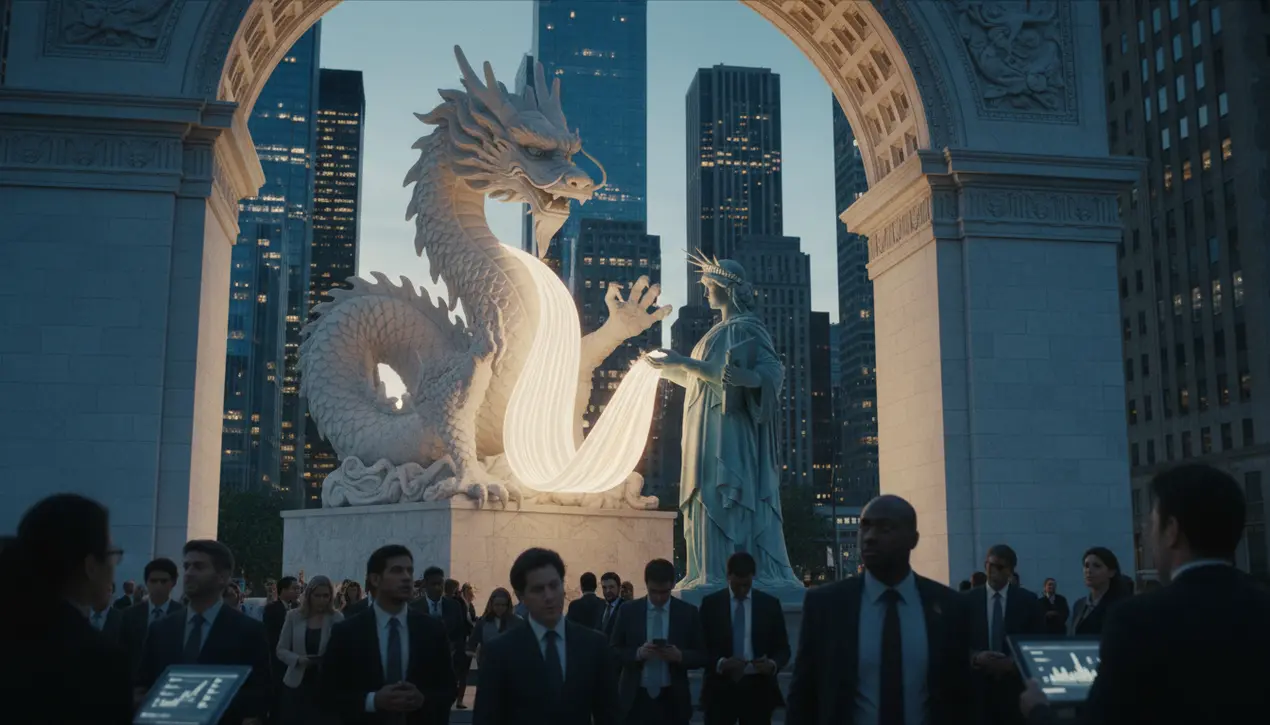

China Leads in Lending to US Since 2000.

OL

Olivia Scott

2 days ago7 min read2 comments

A groundbreaking report from the AidData research lab at William & Mary has pulled back the curtain on the sheer scale of China's global financial influence, revealing that since the year 2000, the United States has been the single largest recipient of Chinese official sector lending, absorbing a staggering $202 billion of a total $2. 2 trillion disbursed.This finding fundamentally recalibrates our understanding of global capital flows, turning the traditional donor-recipient dynamic on its head and positioning Beijing not just as a lender to the developing world, but as a central banker to the world's largest developed economy. For those of us who track the macro-economic currents and the subtle shifts in the global balance sheet, this is a seismic data point, akin to discovering a major, previously unknown tributary feeding into the Mississippi.The flow of capital from China to the U. S., often channeled through state-owned policy banks and entities for infrastructure projects, corporate acquisitions, and treasury purchases, represents a deep and complex financial interdependence that rivals the more publicly scrutinized trade relationship. It forces a reassessment of sovereign risk and debt sustainability models that have long assumed a one-way street of Western capital to emerging markets.From a Wall Street perspective, this massive, sustained inflow has acted as a structural support for U. S.interest rates, helping to keep borrowing costs lower for longer than they might have been otherwise, a factor that has undoubtedly influenced the Federal Reserve's calculus over the past two decades. Think of it as a constant bid in the Treasury market, providing liquidity and demand that has allowed the U.S. to finance its deficits with remarkable ease.However, this symbiotic relationship carries profound geopolitical and financial risks. The concentration of such a significant portion of U.S. debt and project financing in the hands of a strategic competitor creates a potent leverage point, a financial sword of Damocles that could be wielded in a moment of heightened tension.It echoes the lessons of 'too big to fail' but on a sovereign scale; a sudden withdrawal or even a threat of credit restriction from China could trigger volatility across asset classes, from bonds to equities, forcing a rapid and painful repricing of risk. This is not merely an academic concern; it's a live wire running through the heart of the global financial system.The report underscores a critical blind spot in our market analysis: we have been meticulously tracking every basis point move from the Fed and every earnings report from the Magnificent Seven, while a quieter, more profound transformation was unfolding in the architecture of international finance. As we look ahead, investors must now factor in Beijing's credit policy with the same intensity they reserve for Jerome Powell's speeches, because the two are now inextricably linked, binding the fortunes of the world's two largest economies in a high-stakes, delicate, and unprecedented financial embrace.

#China

#United States

#debt

#lending

#global finance

#AidData

#featured

Stay Informed. Act Smarter.

Get weekly highlights, major headlines, and expert insights — then put your knowledge to work in our live prediction markets.

Comments

Loading comments...

© 2025 Outpoll Service LTD. All rights reserved.