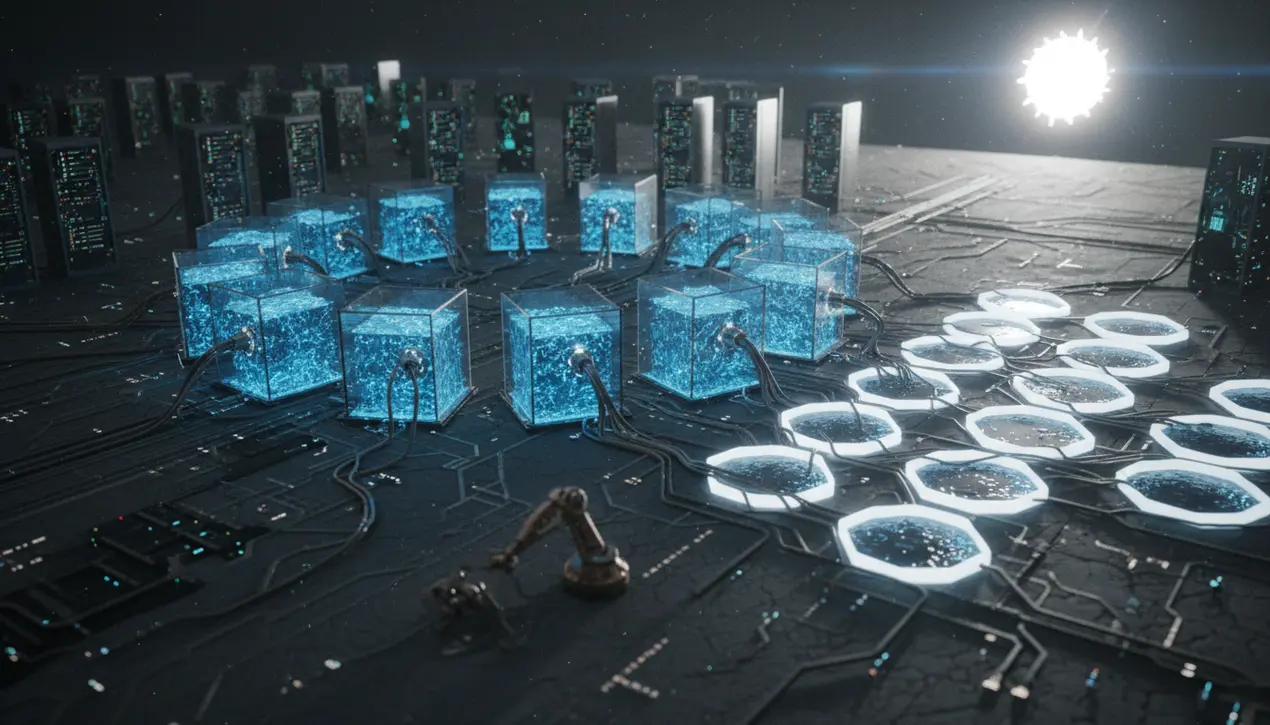

CryptodefiLiquidity Pools

Liquidity Crisis': $12B in DeFi Liquidity Sits Idle as 95% of Capital Goes Unused

AL

Alice Morgan

3 hours ago7 min read

A staggering $12 billion in DeFi liquidity is currently sitting idle, a startling revelation that underscores a profound inefficiency within the decentralized finance ecosystem where a staggering 95% of available capital remains unused. This isn't just a minor operational hiccup; it's a full-blown liquidity crisis that strikes at the very heart of DeFi's promise to create more efficient, open, and accessible financial markets.The core of the issue lies in the fragmented nature of liquidity across hundreds of protocols and a multitude of blockchain networks, from Ethereum and its Layer-2 scaling solutions like Arbitrum and Optimism to competing chains like Solana and Avalanche. Each protocol, whether a decentralized exchange like Uniswap, a lending platform like Aave, or a newer yield-optimizing vault, creates its own isolated liquidity silo.This fragmentation means that capital deposited in one pool cannot be seamlessly deployed elsewhere without incurring significant transaction costs and slippage, leading to massive capital sinks that earn minimal to zero yield. This idle capital represents a monumental opportunity cost for both liquidity providers, who are missing out on potential earnings, and for the DeFi ecosystem as a whole, which is being starved of the fluid capital necessary for efficient price discovery and robust lending markets.The situation is reminiscent of the early, inefficient days of traditional finance before the advent of electronic trading and sophisticated market-making algorithms, where capital was often trapped in unproductive assets. The root causes are multifaceted, including poorly designed incentive structures that reward mere presence over active utilization, the persistent and often prohibitive cost of on-chain transactions that discourages frequent reallocation, and a lack of sophisticated, cross-chain money market protocols that can intelligently route liquidity to where it's needed most.Vitalik Buterin himself has often spoken about the challenges of blockchain scalability and its direct impact on application usability; this liquidity paralysis is a direct manifestation of those unsolved problems. For the ecosystem to mature and truly challenge TradFi, we need a new wave of innovation focused on interoperability and dynamic capital efficiency—think cross-chain atomic swaps becoming as seamless as an API call, and smart contracts that can autonomously migrate funds to the highest-yielding opportunities across any chain in real-time. Until then, this $12 billion ghost town of unused capital serves as a stark reminder that building a new financial system is not just about launching new tokens, but about solving the deeply complex, and often boring, engineering challenges of capital fluidity.

#featured

#liquidity crisis

#defi

#capital efficiency

#yield farming

#decentralized finance

#idle funds

#market analysis

Stay Informed. Act Smarter.

Get weekly highlights, major headlines, and expert insights — then put your knowledge to work in our live prediction markets.

Related News

Comments

Loading comments...

© 2025 Outpoll Service LTD. All rights reserved.