CryptodefiDEXs and AMMs

1inch Unveils Protocol Letting Multiple DeFi Strategies Share the Same Capital

AL

Alice Morgan

2 hours ago7 min read

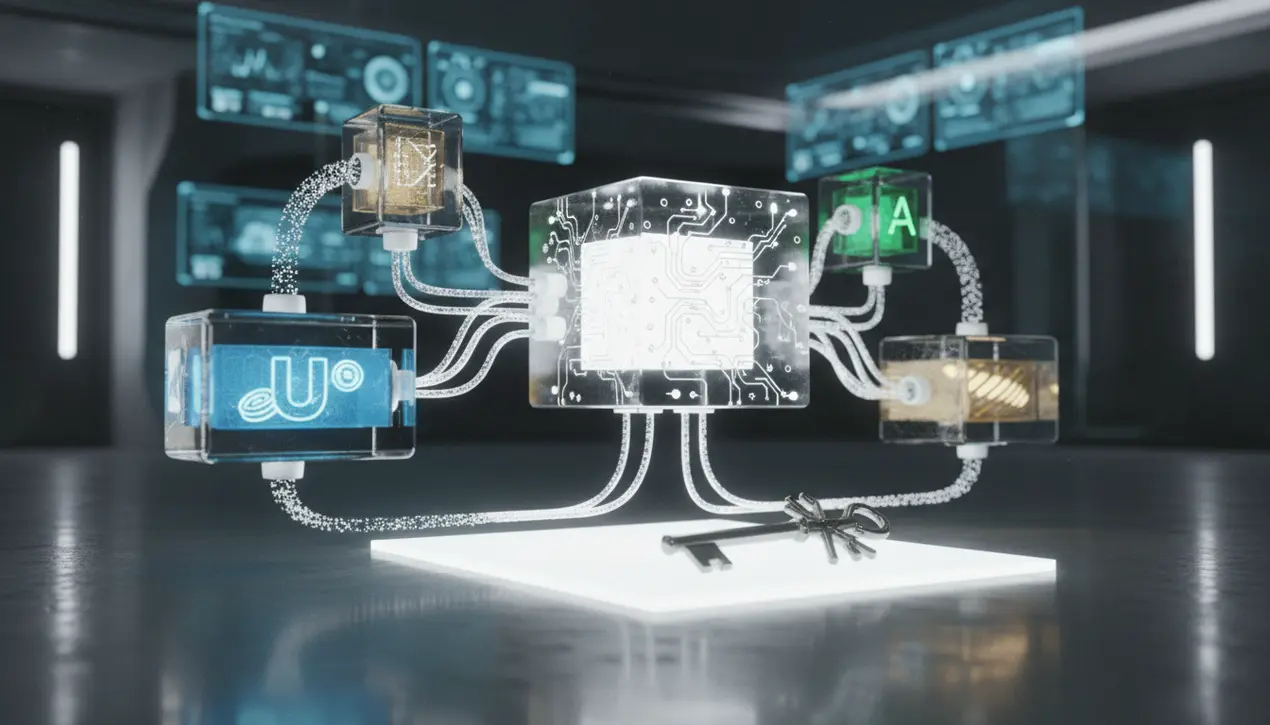

The 1inch Network, a titan in the DeFi aggregation space, has just executed what can only be described as a masterstroke in capital efficiency with the launch of its 'Fusion' upgrade and a new 'Liquidity Protocol'. This isn't just another incremental update; it's a fundamental re-architecting of how value moves and works within decentralized finance.At its core, this protocol introduces a novel concept: allowing a single pool of user capital to be simultaneously deployed across multiple, distinct DeFi strategies. Think of it not as a single key for a single lock, but as a master key system for the entire financial landscape.Instead of your USDC sitting idle in a yield farm on Uniswap V3, it can now be fractionally and programmatically allocated to a lending position on Aave, a leveraged staking position on Lido, and an options vault on Lyra—all at once, automatically, and without the user needing to manually rebalance or even understand the underlying complexity. This is achieved through a sophisticated system of 'resolvers'—essentially, smart contracts that act as autonomous strategy managers, competing in a Dutch auction-style model to offer users the best possible execution for their complex, multi-legged DeFi transactions.The implications are staggering. For the average user, it means their capital is no longer a static asset but a dynamic, multi-tooled employee, working several high-yield jobs around the clock.For the DeFi ecosystem, it represents a leap towards a mature, interconnected financial mesh, reducing the crippling fragmentation that has long plagued the space. It’s a move that echoes the early vision of Ethereum co-founder Vitalik Buterin, who foresaw a world of 'legos' where financial primitives could be composed into infinitely complex and useful products.This development directly challenges the siloed nature of TradFi, where your checking account, brokerage, and retirement fund are separate, non-communicating entities. Here, capital is fluid, fungible, and relentlessly productive.Of course, with great power comes complex smart contract risk, and the success of this model will hinge on the security audits of these resolver contracts and the overall resilience of the system under market stress. Yet, for the Ethereum believer, this is a clear signal that DeFi is evolving from a playground for speculative degens into a robust, sophisticated engine for global finance, one smart contract at a time.

#featured

#1inch

#DeFi

#Fusion mode

#capital efficiency

#liquidity protocols

#yield farming

#decentralized exchange

Stay Informed. Act Smarter.

Get weekly highlights, major headlines, and expert insights — then put your knowledge to work in our live prediction markets.

Related News

Comments

Loading comments...

© 2025 Outpoll Service LTD. All rights reserved.