AIchips & hardwareNVIDIA GPUs

Memory Chip Prices Soar on Strong AI Sector Demand

DA

Daniel Reed

17 hours ago7 min read2 comments

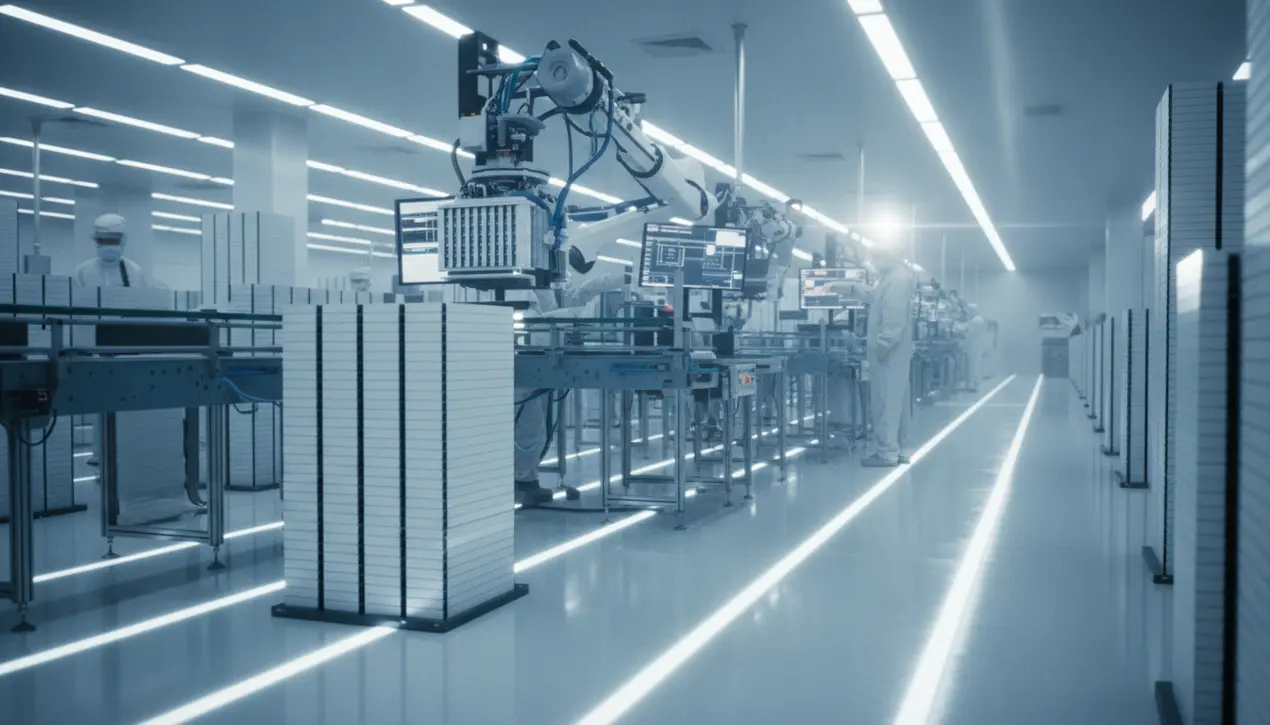

The global memory chip market is experiencing a tectonic shift, driven not by the cyclical patterns of consumer electronics but by the voracious, unrelenting appetite of the artificial intelligence sector. According to a pivotal report from Counterpoint Research, memory chip prices are projected to climb an additional 30% in the final quarter of this year, with a further 20% surge anticipated in 2026, compounding a staggering 50% year-to-date increase.This isn't merely a supply chain hiccup; it's a fundamental restructuring of the semiconductor landscape, where the computational demands of large language models and generative AI are rewriting the rules of engagement. The core of this upheaval lies in the rapid industry pivot from traditional DDR memory, which served the needs of personal computers and servers adequately for decades, towards high-bandwidth memory (HBM) and other specialized architectures like GDDR6X.These are not your grandfather's memory modules; HBM stacks DRAM dies vertically using through-silicon vias (TSVs), creating a massively wide data bus that is essential for feeding the parallel processing beasts that are modern AI accelerators from NVIDIA, AMD, and a growing cohort of custom silicon labs. This rapid shift has created a supply chasm.Giants like SK Hynix and Samsung, who are leading the HBM charge, are reallocating production lines at an unprecedented pace, but the yields for these complex 3D-stacked components are notoriously challenging and capital-intensive. The result is a classic, albeit accelerated, economic squeeze: demand from cloud hyperscalers and AI startups is effectively infinite, while supply is constrained by physics and fab capacity.This has profound second-order consequences that extend far beyond the data center. For the average consumer, the smartphone and laptop they plan to purchase next year will inevitably carry a higher price tag, as manufacturers like Apple and Samsung are forced to absorb these rising component costs.The PC market, which was hoping for a post-pandemic recovery, now faces a new headwind. We are witnessing a cannibalization of semiconductor manufacturing capacity, where the high-margin, high-performance AI segment is siphoning resources from the more commoditized consumer segments.Historically, one could look to the memory price super-cycle of 2017-2018 for parallels, but that was largely driven by a consolidation of suppliers and a surge in demand for mobile DRAM. The current cycle is structurally different; it's driven by a specific, performance-hungry application that requires a complete architectural overhaul.As an AI researcher, this trend validates the immense computational footprint of the transformer architecture and its successors. The pursuit of artificial general intelligence, or even just more capable narrow AI, is proving to be an insatiable consumer of two resources: data and memory bandwidth.While model compression and algorithmic efficiencies are active areas of research, the hardware imperative is clear. The soaring prices are a market signal screaming that the foundational infrastructure of our digital world is being rebuilt, piece by piece, to serve the needs of intelligent machines, and for the foreseeable future, both the industry and the end-user will be paying the price for this new intelligence.

#featured

#memory chips

#price surge

#AI demand

#smartphones

#semiconductors

#supply chain

#Counterpoint Research

#weeks picks news

Stay Informed. Act Smarter.

Get weekly highlights, major headlines, and expert insights — then put your knowledge to work in our live prediction markets.

Comments

Loading comments...

© 2025 Outpoll Service LTD. All rights reserved.