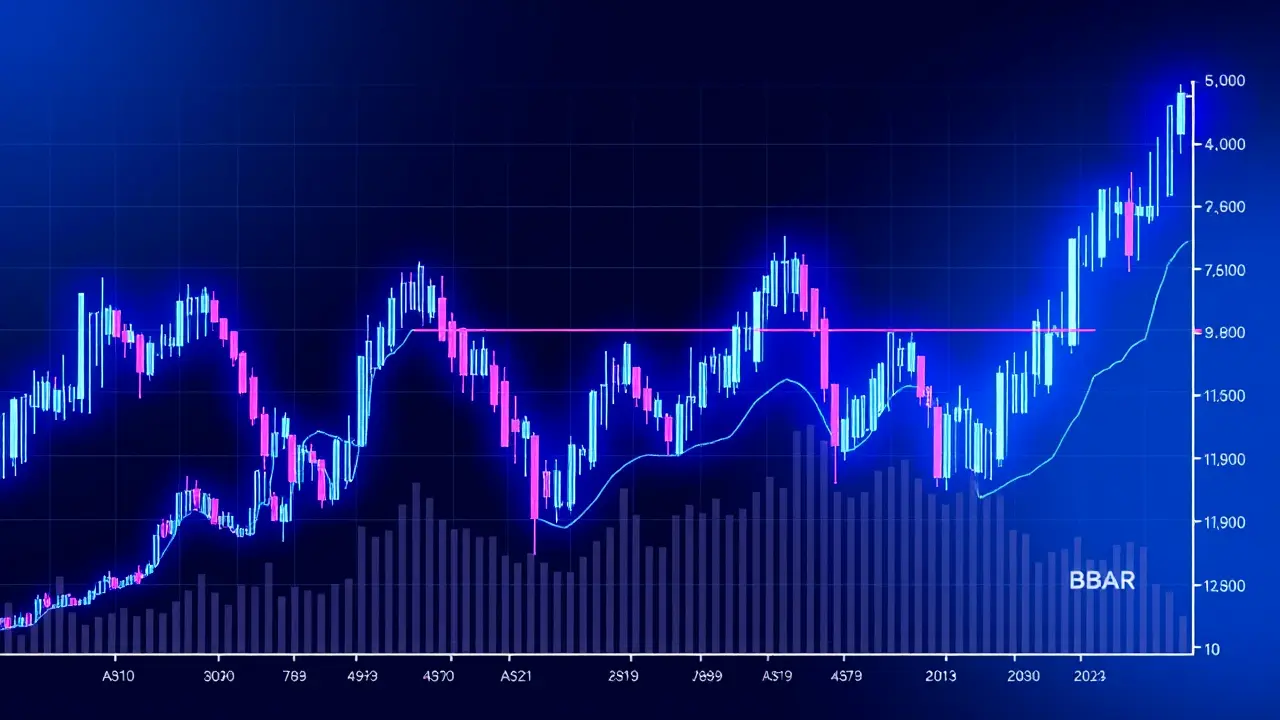

HBAR Rises Past Key Resistance After Explosive Decline

HBAR, the native token of the Hedera Hashgraph network, decisively broke through a key technical resistance level between $0. 190 and $0.191 in a dramatic final-hour surge on October 13, a move that felt less like a random pump and more like a calculated institutional play. The breakout, which saw the price leap from $0.187 to a peak of $0. 191, was not your typical retail-driven frenzy; it was underscored by a stunning, singular transaction of 15.65 million tokens at 13:31, a volume spike so pronounced it screamed of smart money positioning for a new phase. This wasn't just noise—it was a signal, reminiscent of the kind of strategic accumulation that often precedes a sustained leg up in more established crypto assets.The move capped a broader 23-hour rally that began on October 12, where HBAR climbed an impressive 9% from lows around $0. 17, a recovery that demonstrated remarkable resilience.Throughout this period, the asset consistently defended the $0. 18 level, transforming it from a point of contention into a firm support base, a classic sign of strengthening market conviction.For those of us who follow the smart contract and enterprise DLT space, Hedera's performance here is particularly fascinating. Unlike the purely speculative mania that can drive other tokens, HBAR's ecosystem is built on a council of global giants like Google, IBM, and Deutsche Telekom, a governance model that lends a layer of tangible, real-world credibility.This recent price action, therefore, feels like a market acknowledgment of that underlying substance. The high-volume intervals, repeatedly surpassing 10 million units during the breakout window, point directly to sophisticated players—likely those same institutional entities exploring Hedera's energy-efficient hashgraph consensus for enterprise use cases—making their moves.They aren't just trading; they're accumulating, building positions for what they likely see as the next chapter in enterprise blockchain adoption. The technical setup now paints a compelling picture: with sturdy support established in the $0.189–$0. 190 range and the old resistance zone convincingly breached, the path of least resistance appears upward.Of course, the crypto markets are never a one-way street; we must watch for profit-taking near these new local highs and, as always, remain cognizant of broader macroeconomic currents. But for now, the momentum is undeniably bullish.This kind of volume-validated breakout, especially one that holds its ground, often acts as a powerful catalyst, attracting a fresh wave of momentum traders and reinforcing the positive sentiment. It echoes the early patterns seen in other governance-focused tokens before they made their significant runs.If the institutional engagement continues and the wider crypto market remains stable, HBAR's successful conquest of this technical hurdle could very well be the foundation for a more extensive rally, potentially testing levels not seen in months. The narrative is shifting from simple recovery to one of genuine strength and potential, a story that the Hedera community has been patiently waiting to tell.

It’s quiet here...Start the conversation by leaving the first comment.