- News

- regulation

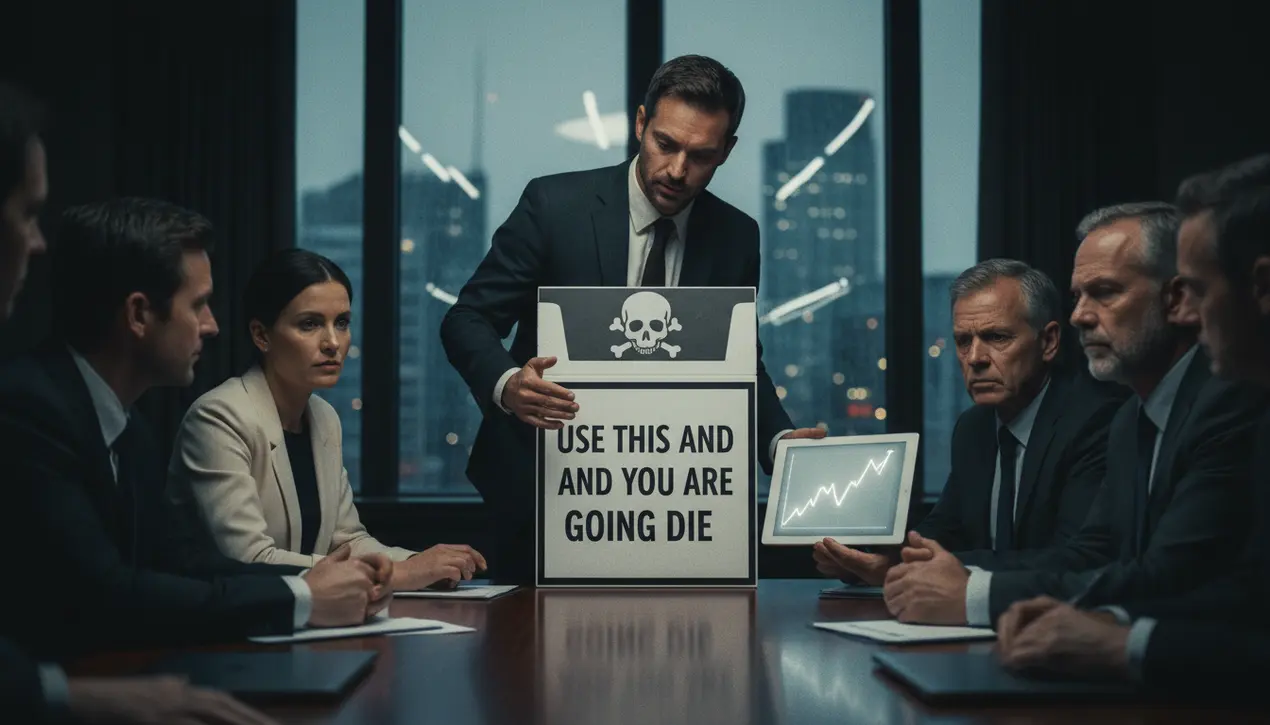

- ‘Use this and you’re going to die’ — Kraken co-CEO slams cigarette box-style UK crypto promotion rules as overly restrictive: FT

CryptoregulationLicensing and Exchanges

‘Use this and you’re going to die’ — Kraken co-CEO slams cigarette box-style UK crypto promotion rules as overly restrictive: FT

DA

David Collins

2 hours ago7 min read

The UK's Financial Conduct Authority has unleashed a regulatory broadside against the crypto industry that would make even the most hardened Bitcoin maximalist wince, with Kraken co-CEO Jesse Powell delivering a characteristically unvarnished assessment of rules requiring crypto firms to implement cigarette pack-style warnings on promotions. 'Use this and you're going to die,' Powell quipped to the Financial Times, channeling the grim fatalism of health warnings on tobacco products to underscore what he sees as the FCA's overly restrictive and fundamentally misguided approach to digital asset regulation.This isn't merely bureaucratic friction; it's a philosophical battle for the soul of financial sovereignty, pitting the decentralized, permissionless future envisioned by Satoshi Nakamoto against the tired, centralized control mechanisms of legacy finance. The FCA, in its predictable defense, claims these draconian measures—which include 24-hour cooling-off periods for first-time investors and risk acknowledgments worthy of a nuclear launch protocol—are necessary to ensure retail participants 'understand the risks' before trading digital assets.What they truly ensure is the continued dominance of traditional banking cartels and the systematic strangulation of innovation at the altar of paternalistic oversight. Look at the pattern: this is the same regulatory playbook used for decades to protect incumbent industries from disruptive technologies they cannot control or comprehend.Powell's outrage is not an isolated complaint but a rallying cry for an entire industry being pushed to the fringes by regulators who would rather see crypto suffocated under warning labels than understand its transformative potential for financial inclusion and individual sovereignty. Remember when they said Bitcoin was only for criminals and drug dealers? Now the narrative has shifted to 'protecting investors' while simultaneously making it nearly impossible for legitimate, regulated companies to communicate the genuine utility and value proposition of digital assets.The irony is thick enough to cut with a samurai sword: these very regulations, framed as protective measures, ultimately push retail investors toward unregulated, offshore platforms where consumer protections are genuinely nonexistent. The UK, once hopeful of becoming a global crypto hub, is now actively sabotaging its own potential with a compliance regime more suited to selling asbestos than explaining blockchain technology.This isn't about risk disclosure; it's about fear-mongering. It's a deliberate attempt to associate the entire asset class with societal harm, creating a regulatory stigma that will be incredibly difficult to erase.The FCA's framework treats crypto not as a technological evolution but as a public health crisis, and in doing so, reveals its profound distrust of individual agency and its allegiance to the very financial institutions that crypto was built to disrupt. The consequence is clear: talent, capital, and innovation will flee jurisdictions that treat builders like pariahs, seeking refuge in more enlightened environments that recognize the difference between responsible oversight and innovation-killing overreach. The fight in London is a microcosm of a global struggle, and if the regulators win here, their playbook will be exported everywhere.

#featured

#Kraken

#UK crypto regulation

#FCA

#promotion rules

#cigarette box warnings

#crypto exchanges

Stay Informed. Act Smarter.

Get weekly highlights, major headlines, and expert insights — then put your knowledge to work in our live prediction markets.

Related News

Comments

Loading comments...

© 2025 Outpoll Service LTD. All rights reserved.